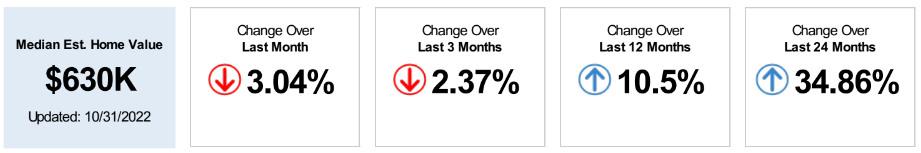

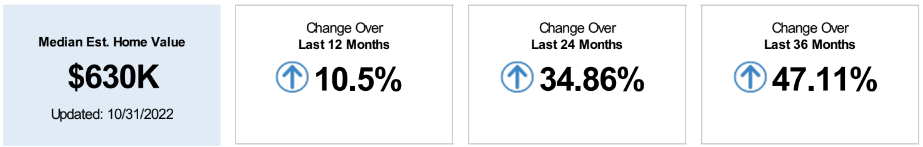

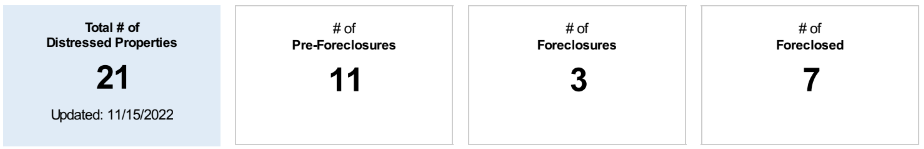

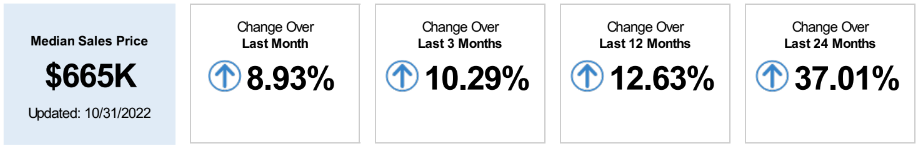

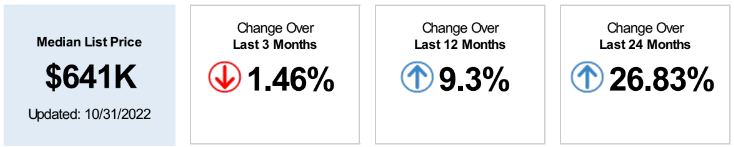

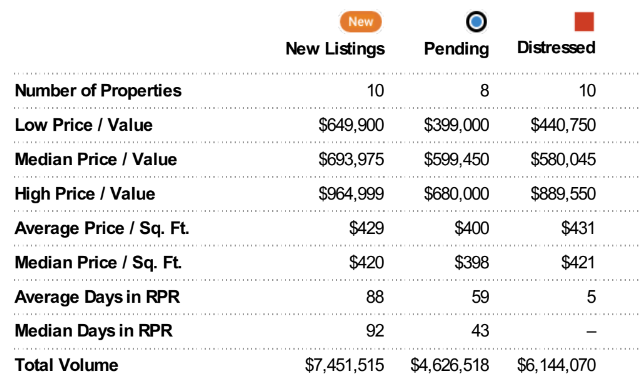

Wondering what the housing market in Montclair, CA is like today? The newly released market statistics from Realtors Property Resource (RPR) are in, showing recent real estate market activity in Montclair, CA. Here’s a detailed breakdown of the statistics generated on October 31st, 2022. Market Snapshot: Estimated Home ValuesMarket Snapshot: 12-Month Change in Estimated Value Market Snapshot: Concentration of Distressed Properties Market Snapshot: Sales Price Market Snapshot: List Price Montclair, CA SUMMARY Stats: WANT TO KNOW MORE?

In Montclair, no matter what real estate needs you have, you’ll need one of the best real estate agents to get you the price you want. I’m always here to help you navigate the local market. I can analyze the specific neighborhood and price range for you, whether you are interested in buying or in selling. Contact me today for a customized look at the latest conditions for the Montclair real estate market and beyond.

0 Comments

If you’re a homeowner looking to finance a home-remodeling project, consolidate credit card debt, and/or pay for big-ticket purchases, you may want to weigh the benefits offered by a Home Equity Line of Credit, or HELOC. In this article we’ll explore HELOCs and how to determine if they are right for you. What Is a HELOC? HELOC is an acronym for a home equity line of credit. It's a line of credit consolidated by the equity in your home, which gives you access to a line of credit that you can use for significant expenses. The interest rates for HELOC loans are considerably less when compared to other loans. HELOC often has a draw period of ten years, and at this time, you can borrow any amount you want. After the draw period ends, the repayment period, which is generally up to 20 years, begins. Your house is the collateral for the loan. So instead of paying out in full at closing like an average mortgage, a HELOC is a lender’s promise that the lender will advance the borrower's loan for a set amount of time of the borrower's choosing. The market value of your property decides how much you can take out in HELOC. For instance, if your property value is $500,000 and you’ve paid up to $300,000 in mortgages, you may qualify for $40,000 to $140,000 dollars in HELOC. It all depends on your credit score. An excellent credit score increases your eligibility. Factors to Consider When Determining If a HELOC Is Right for You While a HELOC offers a flexible way to unlock funds from the equity in your home, it’s important to do your homework to determine if it is the right choice for your financial circumstances. When considering a HELOC, and shopping for a lender, understand features including: Draw periods: During this term, also known as the borrowing period, you may spend, or “draw” funds from a HELOC to pay for expenses as you see fit. This period may range from five to 10 years, based on the lender. Once it concludes, you may no longer spend funds from the HELOC. Repayment periods: At the conclusion of the draw period, the repayment period—or period where you pay back both the funds you used and accumulated interest—begins. Interest rates: Interest rates for a HELOC vary among lenders but are generally lower than you would pay on a credit card. Many lenders offer either a fixed interest rate (which remains the same throughout the loan) or a variable interest rate (fluctuates based on changes initiated by the Federal Reserve). Credit line amounts: This total loan amount is determined based on the equity in your home as well as your current financial health according to your credit score, income, debts, assets and other factors. Most lenders limit maximum HELOC lines of credit to around 80 percent of your home equity. Applying for a HELOC The process of applying for a HELOC is similar to what you likely experienced when applying for your home mortgage. Initially, you will complete and submit an application online. Then, for verification purposes, you may also need to provide documents including:

You’ll also need to factor in a range of closing costs for your HELOC such as appraisal fees, attorney fees, origination fees, and application fees. Overall, HELOCs can offer homeowners a flexible option to help pay for big-ticket items or consolidate high-interest debt. Be sure to understand the features, as well as any associated costs and fees, before finding the one right for you. What does a good lender look like?If you've never bought a home before it can be overwhelming. One of the most important part of homebuying is finding a great mortgage lender. But what does a good lender look like? Here are some tips when finding a lender! Green Flags to look for Open Communication A great lender will always keep in touch with you and communicate effectively. They must have extensive knowledge of the industry and be able to give you up to date information on the market. If you don't understand something in a disclosure you should ask your lender, and they should be able to explain it to you. Works with you You should be able to be open with your lender on what budget you are comfortable with and a good lender will be able to give you information and find the right loan program for you without pushing your boundaries. Reputation matters! Always ask around when you are looking for a lender. Your ideal candidate should have a proven successful track record. Do your due diligence and see what kind of experiences have they provided to their clients. Honest and Direct A good lender should be able to tell you their rates, loan terms, down payment requirements, mortgage insurance, closing cost and fees. They wouldn't need to keep things vague and ambiguous or hit you with hidden fees later on. Things you can do before applying for a loanA good lender is important but there are things you can do to ensure success when applying for a loan.

Credit Scores Take a close look at your credit score and if it is not where you want it to be, then look for ways to improve it. If your score is not at the ideal spot when you are looking to buy a home then you need to keep in mind the rates and requirements for applying will be harsher on you. Do your research! It is always a good idea to get multiple estimates from different lenders. Shop around and compare these rates to each other. You can do a preliminary online search prior to meeting with lenders as well. Know what you need There are many different types of mortgages. Before you are able to look for the right lender you need to figure out what type of mortgage you want and it will be a good starting point for you to try and find the right lender to be able to help you get that loan. When is it time to expand your business?One of the most important question in business is, when is it time to expand and the answer might not be very clear. Here are some tips for you! Do you have the demand? Before thinking of expanding your business there must be a demand for your service. If your home base is in one city but you have many customers inquiring from another area then perhaps it is time to expand to another location. Can you do your job efficiently? As demand for your business grows, there will be more responsibilities for you to take of. If there is more demand for house showings and consultation then you can hire an operations manager to help organize your activities. Likewise, it might be a good idea for you to hand off other aspects of your organization to a professional such as marketing! Do you have a lot of cash? Having a safety net of cash is great however too much of it can be inefficient. The money that you have should be reinvested back into your business to help it grow. You can also use this money to invest in other ventures that support your current business. Perhaps you can start a real estate photography business on the side. How to expand your business

Invest in a CRM A CRM is a Customer Relationship Management system. This is crucial in real estate because it will help you organize your leads and establish a system to make the home buying or leasing process easier and more efficient. Create a website for you business If you haven't already done this as a realtor then you must. In this day an age, everything is done online. Before contacting you, your clients will want to be able to see your work and let you advertise what you do at the comfort of their own home. It also makes a good point of reference when they need to contact you or while choosing a service. Referrals and Networking In the real estate industry, a connection can get you far. Make it a point to attend networking events and when you network with someone make sure to follow up. Nurture those relationships and ask for referrals. The best part about referrals is that it is free marketing! Be on top of your stuff! It is a competitive market out here and you need to be aware of the ever changing landscape. Being in the know about the market will give you good insights on how to better market to your audience. If it is a seller's market how can you market this to home owners and if it is a buyer's market how can you make it more enticing for home buyers? There are many more ways to to expand your business these are just a few ideas to get you started! The opportunity zone program was created by the Tax Cuts and Jobs Act of 2017 to revive economically distressed communities using private investments.

What are Qualified Opportunity Zones? The opportunity zone program is intended to stimulate positive growth in certain communities. So there are restrictions on the investments which an Opportunity Fund can invest. These types of investments are called “Qualified Opportunity Zone Properties,” which are:

How investing in opportunity zones works In exchange for investing in opportunity zones, investors can defer their capital gain taxes till 2026. In addition, investors who hold their investments for at least five years before December 31st, 2026 are entitled to a 10% reduction in their capital gains tax basis. Investors who keep their investment for at least seven years are entitled to a 15% reduction in their capital tax basis. Investors who hold their investment for at least ten years will not have to pay any capital gains taxes. To access these benefits, investors must invest in Opportunity zones through Opportunity Funds; which are investment vehicles created to take advantage of the opportunity zones program. Opportunity funds must keep their assets in a Qualified Opportunity Zone (QOZ). Opportunity funds can also self-certify to the IRS and do not need any approval from anybody. The Best Opportunity Zones in California California has lots of Opportunity Zones with opportunities to invest. While major Opportunity Zones in California are located far inland, there are several Opportunity Zones in places like San Francisco and Los Angeles. San Francisco Bay Area: Cupertino, San Jose, and Oakland Cupertino, Oakland, and San Jose are hosts to multiple Qualified Opportunity Zones. Oakland is a promising investment area, as home values have gone from $309,000 to $734,000 over the last nine years. Much like San Jose, home values have also gone up in seven years, from $487,000 to $1.07 million from 2012 to 2019. The increase in home values has made the market enticing for Opportunity Fund Investors. Los Angeles: Koreatown, DTLA, and The Arts District The LA Arts District and Downtown LA (DTLA) is one of the fastest-growing urban areas in Los Angeles. Much of Downtown LA is located within Opportunity Zones, providing enticing opportunities for investors. Koreatown is another fast-growing area in Los Angeles. In 7 years, real estate prices in Koreatown went from $333,000 to $637,000, almost double their initial cost. Benefits of Opportunity Zone Programs The main benefits of Opportunity Zone programs are projects and businesses in the zones are eligible for investments, and investors are eligible for tax benefits in exchange for investing in projects in the Zone. More benefits of the Opportunity Zone Program include: For Businesses and Projects in the Zone:

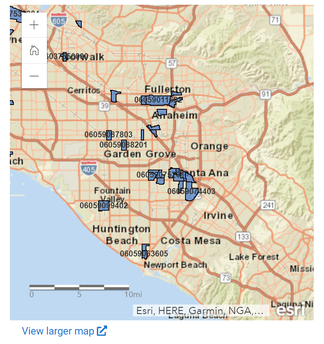

Orange County, California has 27 designated Opportunity Zones. In total these Opportunity Zones have a population of approximately 170,000. That represents 5% of the county’s total population of 3,200,000. The median household income for Orange County Opportunity Zones ranges from approximately $39,000 to $65,000. The adjacent map shows all Opportunity Zones in Orange County. Click on any Opportunity Zone for additional information. Read more here...  When you buy a home, its care and keeping need to become a priority. One way to ensure that its systems and appliances are taken care of is by investing in a home warranty. However, while warranties can be the key to easy home maintenance for some, they’re not right for everyone. If you’ve been thinking about getting one for your home, read this first. We’ve listed out the pros and cons to help you decide if getting a home warranty is the right choice for you. What is a home warranty?

How a home warranty works?

The benefits of a home warranty

Additionally, it can be a shrewd money move for those who need to budget carefully or simply like to be ahead of the game with their financial planning. With a home warranty, there are fewer unanticipated costs. You’ll know what your premium costs upfront and you’ll know what your deductible is for any repairs that are covered under the warranty, making it much easier to handle the unexpected. The drawbacks of a home warrantyHowever, one major pain point of most warranties is that they won’t cover items that have not been properly maintained. Since what constitutes “properly maintained” is very subjective, this clause is often the cause of disputes between the homeowner and the warranty company. Particularly if, say, the previous owner did not take care of the appliance and the new homeowner is left hanging. Another issue, for some, is that each year money is paid upfront under the assumption that repairs will eventually need to be made. However, that may or may not be the case. Some years, everything may work fine, but you’ll have paid the premium, regardless. Making the decision

Written by: Tara Mastroeni

Source: https://www.tmrealestatewriter.com/

✔ IF there is a WILL there is a way! ✔ ProsThere is an alarming rate between 1000-1500 + Homeless in just the San Bernardino County. Majority are registered under Section 8. There are many out in the street and majority of the reason why they are homeless is because there are not enough homeowners/ homes that are SECT 8 approved. From LA County, Orange County, and San Bernardino County, we can help you guarantee your income, screen tenants after they have been pre-approved with Section 8, take advantage of the marketable pool for tenants to select from to find the perfect tenant for your home, and benefit from the free advertising provided by housing. Around the ConsFor the routine inspections, as your management team, I am knowledgeable of what is required and necessary to repair or install prior to inspection date. As for the rent control, good tenants of section 8 are well aware of the market rent and are always willing to pay the listed rent, if the rent listed is reasonable. As for difficult tenants, I mentioned before, we would pre-screen them after they have been approved with SECT 8 . For any reason we need to evict, All our evictions have been successful and can be accomplished within 1-2 month. Source: Homeless Rate: http://wp.sbcounty.gov/dbh/sbchp/wp-content/uploads/sites/2/2016/08/2017-SBC-Preliminary-Point-In-Time-Count-Report.pdf

Source: Article, How to Become a Section 8 Housing Landlord: https://www.moneycrashers.com/become-section-8-housing-landlord-requirements/ If you’re looking to buy new carpet, you’re in good company. According to the trade journal “Floor Covering Weekly,” carpet accounts for more U.S. sales than all other flooring types combined.

With good reason: It’s inexpensive, easy to install and comes in hundreds of colors, textures and styles. Plus it’s soft and warm to the touch, and a good sound blocker. Got kids learning the trumpet? Carpet their room. With many types of carpet available, making a decision isn’t easy. Here’s a guide to get you started: Carpet Styles The two main types of carpet construction are defined by the way the carpet fibers are attached to their backing. Loop pile means the fibers are bent into little loops. It’s a very durable, stain-resistant carpeting, but has a low profile and limited cushioning. Within the loop pile family are: Level loop is also called Berber. This type of carpet features short loops that stand up well in high traffic areas. Multi-level loops mean the tops of the loops vary in height to give a carpet a patterned texture. Cut pile carpets cut the yarn tips so there aren’t any loops. Cut pile carpets tend to be denser and softer than loop pile. There are several types of cut pile: Plush has an even, smooth texture with a formal appearance. Saxony has a smooth finish, but the fibers are longer and twisted to give each fiber more body. It’s popular, but the longer fibers mean footprints linger and furniture creates dents. Textured cut pile has fibers of uneven lengths to create a rougher surface texture. Frieze carpet has long fibers and isn’t recommended for high traffic areas. In its most extreme form, it’s known as shag carpet. Cable has long, thick fibers and is very comfortable underfoot. Cut and loop is yet another type of carpet that has both cut pile and loop pile fibers and combines the best qualities of both. It’s good for hiding dirt and stains. Types of Carpet Fibers Carpet is made from various synthetic and natural fibers. Each has different characteristics. Nylon is the most popular. It’s durable and resistant to wear. It’s not good at fighting stains, so some varieties include a stain-resistant treatment. Olefin is resistant to moisture, mold, and mildew and makes a good carpet for basements and outdoors. It’s tougher than nylon, but not as comfortable to walk on. Acrylic is often used as an inexpensive alternative to wool. It’s not widely available. Wool is the premier carpeting and the only natural fiber made into carpets. It’s durable and stain-resistant, and it’s considered an ecofriendly floor covering. Judging Quality There’s no universal grading for carpet quality, so beware of manufacturer’s claims to offer one. Instead, consider weight and density. Weight indicates how many fibers are present in the carpet. The more fibers, the heavier the weight and the higher the quality of the carpet.Density shows how many fibers are in the pile and how closely packed the fibers are. The denser, the better. You can “field test” density with your fingers — if you can feel the carpet backing, the carpet won’t be very dense. Popular Misnomers Two types of area rugs that are commonly called “carpets” are Persian carpet and sisal carpet. Both have loop pile construction. Find out more… Source: https://www.diynetwork.com/how-to/rooms-and-spaces/floors/your-guide-to-the-different-types-of-carpet Investment property is something I wanted to get into since I started property management. Why not build income and help the unfortunate. Residual income is a great way to grow income and build equity with a great tenant. It all starts with the application process and who your tenant is. I can help you walk through this process, and can manage your property. . . . #HUD #affordablehousing #SECTION8 #BUILDD #ourcommunity |

MartyInstagram Archives

August 2023

Categories |

HoursM - Sat

9:00am - 5:00pm |

TelephoneDirect 714-312-6788

|

|